Entrepreneurs today have a wide array of options when it comes to deciding where to set up or expand their business. Making the mere decision to choose the best point of next business activity can become tricky since there would be so many factors to consider. And that might even be one of the biggest leaps that you’ll be taking in your endeavour. So it is vital that you make an informed decision knowing the pros and cons, the advantages Malta offers to new businesses and how other entrepreneurs do their businesses in Malta.

Malta’s Booming Business Ecosystem

An increasing number of businesses are being registered in Malta, thanks to the advantages this European country provides.

Malta has always been considered an attractive destination for growing businesses due to its political and economic stability, its strategic location between Europe and Africa, and its highly skilled workforce.

Lately, the government has been taking multiple measures to make the country even more attractive to new businesses, such as offering subsidies and tax incentives, investing in infrastructure projects, and providing a one-stop shop for business registration.

Today, we are going to take a more detailed look at the advantages that businesses enjoy established in Malta.

Advantages of running a business in Malta

Located in the middle of the Mediterranean, Malta has a long and rich history dating back thousands of years. The country is further a popular tourist destination, thanks to its sunny climate, beautiful beaches, and historical sites. This has given a significant boost to the Maltese economy, making it one of the fastest-growing economies in Europe.

The Maltese government is committed to attracting more businesses to the country and has put in place several advantages and benefits. These include:

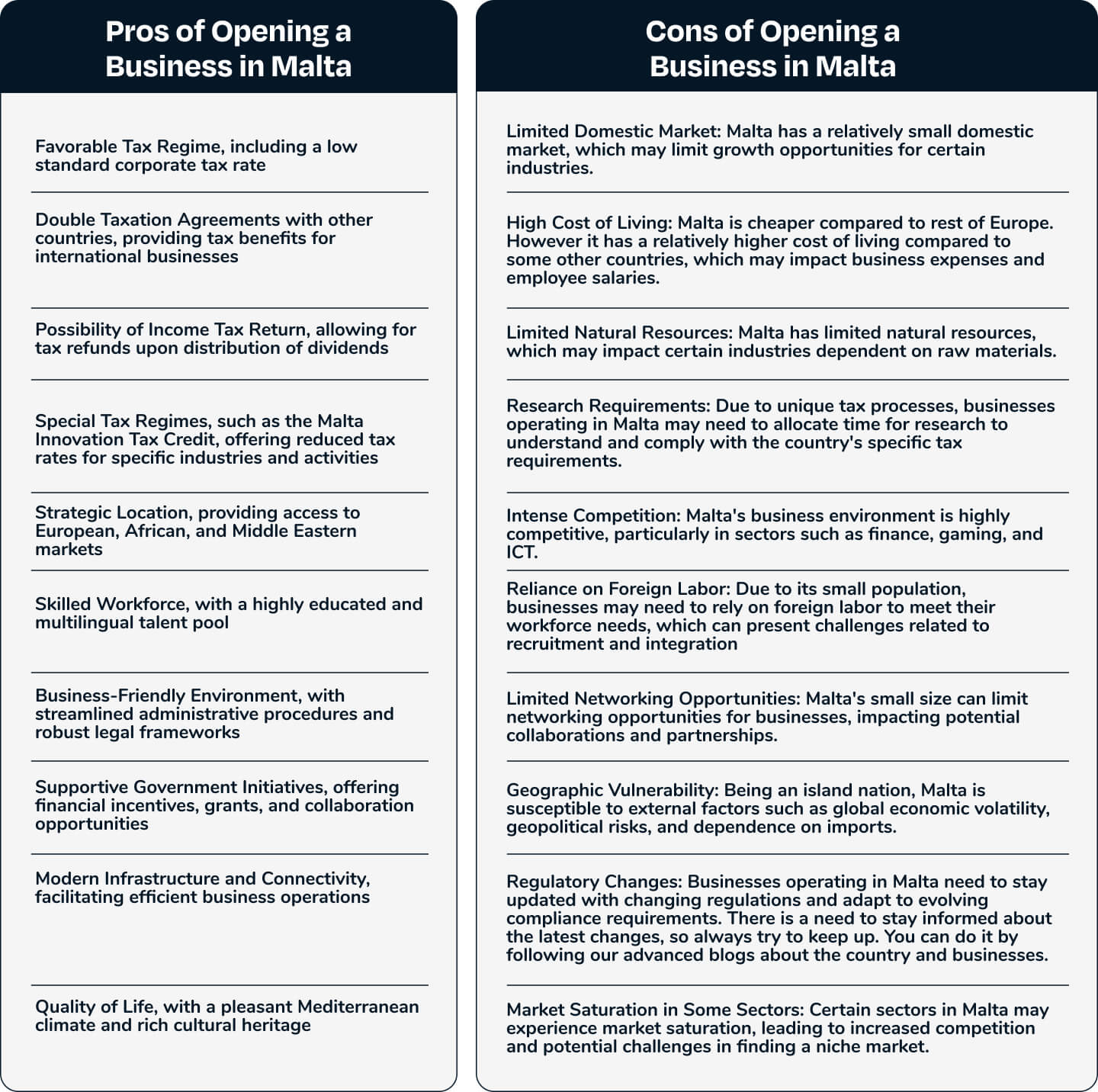

A favourable tax regime

Malta has one of the most favourable corporate tax regimes in Europe, with a standard corporate tax rate of 35%. This low tax rate in comparison to other countries in Europe applies to both local and foreign companies. In addition, businesses can take advantage of a wide range of double taxation agreements that Malta has in place with other countries.

Malta operates a full imputation system, which means that when a Malta-based company pays taxes on its profits, shareholders are eligible for a refund of the tax paid. This ensures that the same profits are not subject to double taxation, providing an attractive incentive for businesses and investors.

Malta also offers a participation exemption regime, wherein dividends and capital gains derived from qualifying shareholdings are exempt from tax. This regime applies to both local and foreign-sourced income, making it beneficial for companies with investments abroad.

Additionally, Malta provides generous incentives and tax credits for specific industries and activities. For example, the Maltese government offers incentives for research and development (R&D) activities, including tax credits and deductions for eligible R&D expenditure.

Moreover, Malta has a favorable tax regime for intellectual property (IP) assets. Companies that hold qualifying IP assets can benefit from a reduced effective tax rate on royalty income derived from the use or exploitation of those assets. This tax regime serves as an incentive for businesses to develop, protect, and exploit their IP assets within Malta. By holding qualifying IP assets, companies can enjoy a lower tax burden on the royalty income they earn from licensing or utilizing their intellectual property.

It's worth noting that while Malta offers an advantageous tax regime, it is essential to comply with local tax laws and regulations. Consulting with a tax professional or advisor who is familiar with Maltese tax laws is recommended to ensure compliance and maximise the benefits of the tax regime.

Income Tax Return

The Maltese government also offers a number of tax incentives for businesses, such as the possibility of claiming backup income tax upon distribution of dividends to shareholders. This makes Malta an ideal jurisdiction for holding companies.

The rate of return depends on multiple factors. This can be either 2/3, 5/7 or 6/7 of the tax paid in Malta, depending on the shareholding structure and the activities undertaken by the company.

In Malta, the tax refund system for dividends is known as the Full Imputation System. Under this system, when a Malta-based company pays taxes on its profits, shareholders are eligible for a refund of the tax paid upon distribution of dividends.

The rate of the tax refund depends on various factors, including the shareholding structure and the activities undertaken by the company. Here are the three different rates of tax refund applicable in Malta:

- 2/3 Tax Refund: This rate applies when the company distributing the dividends has claimed double taxation relief (i.e., benefited from a double tax treaty or unilateral relief) on the profits out of which the dividends are paid.

- 5/7 Tax Refund: This rate is applicable when the company distributing the dividends does not qualify for the 2/3 tax refund but carries on trading activities or has passive interest or royalties income that is subject to foreign tax of at least 5%.

- 6/7 Tax Refund: This rate is available when the company distributing the dividends does not qualify for the 2/3 or 5/7 tax refunds. It is the highest refund rate and applies to dividends paid out of income that does not fall into the categories mentioned above.

It's important to note that these tax refund rates are subject to certain conditions and limitations. Additionally, shareholders may need to fulfill specific criteria to be eligible for the tax refund.

To fully understand the implications and benefits of the tax refund system, it is recommended to consult with a tax professional or advisor familiar with Maltese tax laws and regulations. They can provide guidance tailored to your specific business circumstances.

Special Taxes

A special tax of 15% is applied to income derived from certain activities that are carried out in a “knowledge-intensive” environment. These activities include research and development, high-tech manufacturing, and the development of software applications.

Grants and Funding Programs

Malta has several grant schemes and funding programs available to support entrepreneurs and businesses. These programs provide financial support for startups, innovation projects, and business expansion. The Malta Enterprise, a government agency responsible for promoting investment and economic growth, administers these schemes and provides guidance on accessing the available grants and funding opportunities.

Open a business account online without visiting the country

One of the advantages of having a business in Malta is the option to open a business account online without physically visiting the country. This is made possible through digital solutions such as wamo, which allows business owners to control and streamline their expenses, create multiple sub-accounts, and issue virtual debit cards effortlessly. With wamo, all financial transactions are secure and hassle-free, making it a convenient and accessible option for freelancers and business owners who are unable to travel to Malta. By leveraging digital solutions, freelancers and business owners can easily manage their finances and take advantage of the benefits of having a business in Malta.

Other benefits of running a business in Malta

A stable political and economic environment: Malta is a politically stable country with a strong economy. It is also ranked as the 15th safest country in the world, making it an ideal destination for businesses.

Access to the European Union market: Malta became a full member of the European Union in 2004 and is part of the Eurozone. This provides businesses with easy access to the EU market of over 500 million consumers.

A highly skilled workforce: Malta has a well-educated and English-speaking workforce. In fact, the Maltese population has one of the highest rates of tertiary education in Europe.

A favourable location: Malta is strategically located between Europe and Africa, making it an ideal base for businesses that are looking to tap into both markets.

A one-stop shop for business registration: The Maltese government has set up a one-stop shop, called the Malta Business Registry, which provides all the necessary information and services for businesses that are looking to register in Malta.

Startup funding: The Maltese government offers a number of funding schemes for startups, such as the Malta Enterprise Grant Scheme and the Business First Grant Scheme.

Disadvantages of having a business in Malta

High operating costs:

The cost of living and doing business in Malta can be relatively high compared to some countries, especially if you’re from a developing country., which can make it difficult to maintain profitability in the beginning.

Limited market size:

Malta is a small island nation with a limited market size, which can make it challenging for businesses to grow beyond a certain point.

Limited access to larger talent-base:

As a small country, Malta may have limited access to skilled workers, although satisfactory for SMEs. Particularly in niche industries or areas of expertise might opt for neighbouring European countries to continue their expansion.